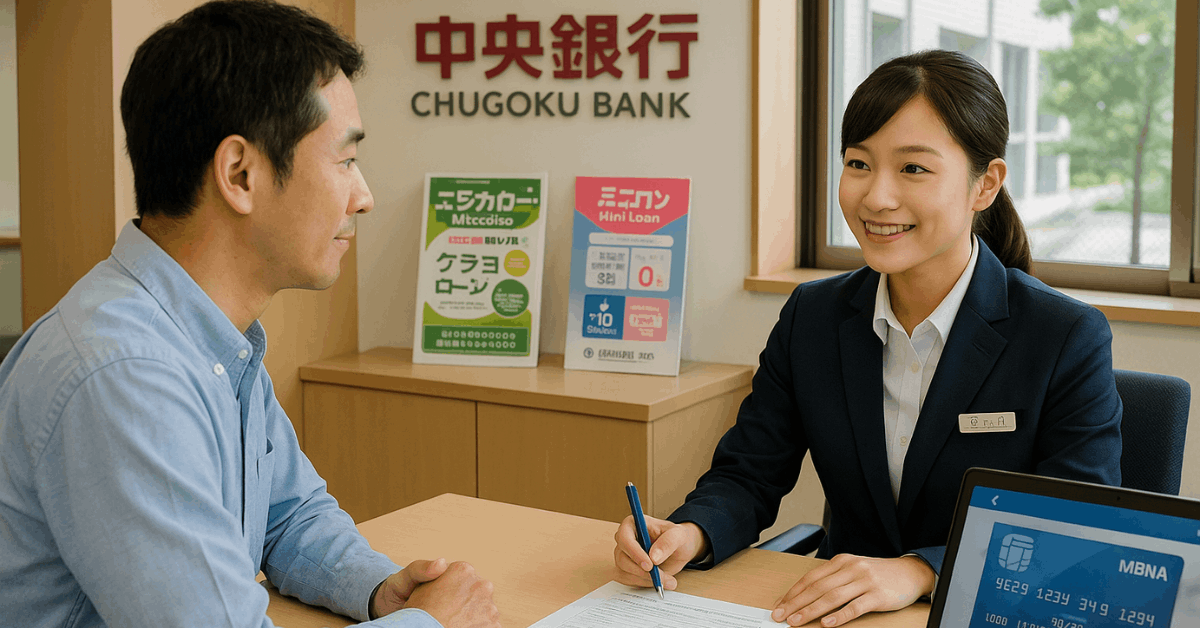

Chugoku Bank provides dependable personal loan options backed by clear terms, stable interest rates, and efficient processing.

Customers can access tailored credit lines for emergencies, planned expenses, or debt consolidation without excessive paperwork or guarantor requirements.

This guide explains the available loan products, application steps, and how to qualify.

Get Reliable Funding From a Local Leader: Chugoku Bank

Chugoku Bank stands out across Japan for steady service, realistic lending limits, and interest rates that reward loyal banking habits.

You gain access to flexible revolving credit lines without enduring complicated guarantor demands or excessive paperwork.

Strong corporate fundamentals assure you that the lender can support long-term relationships.

- Founded: 1930

- Head office: Okayama Prefecture

- Business segments: banking, leasing, securities, and related services

- Employees: about 3,170

- Chief executive: Masato Miyanaga

The bank shifted to a holding-company structure in 2022, allowing each division to focus sharply on customer needs while maintaining unified risk controls.

Loan Menu You Can Tap Today

Selecting the correct product means comparing limits, price tiers, and loyalty discounts against your cash-flow targets. Chugoku Bank currently promotes two personal revolving credit lines.

Card Loan Mini

Quick access to modest funds makes this option ideal for emergencies, small tuition gaps, or household repairs.

| Fixed Limit Options | Standard Annual Rate | Relationship Discount* |

| ¥100 000 | 10.0 % | up to 1.5 % off |

| ¥300 000 | 10.0 % | up to 1.5 % off |

| ¥500 000 | 10.0 % | up to 1.5 % off |

*A 0.5-point cut applies for each qualifying transaction (salary or pension deposit, time-deposit balance, or three automatic utility debits) arranged at the branch where you sign the loan, max 1.5 points.

Why choose it? You secure predictable costs, minimal documentation, and a one-visit approval path.

Card Loan Koreca: Standard Pricing

Higher ceilings suit substantial renovations, education abroad, or strategic debt consolidation.

| Limit Band (¥) | Annual Interest |

| 100 000 – 900 000 | 14.5 % |

| 1 000 000 – 1.9 million | 13.0 % |

| 2 million – 2.9 million | 11.0 % |

| 3 million – 3.9 million | 9.0 % |

| 4 million – 4.9 million | 7.0 % |

| 5 million – 5.9 million | 4.8 % |

| 6 million – 6.9 million | 4.5 % |

| 7 million – 7.9 million | 4.0 % |

| 8 million – 8.9 million | 3.0 % |

| 9 million – 9.9 million | 1.9 % |

Rates already include the guarantee fee and may shift when market conditions change.

Home-Loan Preferential Plan

Holding an active Chugoku Bank mortgage unlocks significant Koreca cuts.

- Up to ¥3.9 million: 8.0 % flat

- ¥4 – 4.9 million: 6.5 %

- ¥5 – 5.9 million: 4.8 %

- ¥6 – 6.9 million: 4.5 %

- ¥7 – 7.9 million: 4.0 %

- ¥8 – 8.9 million: 3.0 %

- ¥9 – 9.9 million: 1.9 %

Signing online applies standard rates, so a branch visit can save you thousands over the life of the loan if you already service a mortgage with the bank.

Eligibility Requirements to Confirm First

Verifying that you meet each rule prevents avoidable delays.

- Age range: 20 to 65 at contract signing and under 70 by final repayment.

- Income type: salary, self-employment revenue, or pension documented through payslips, tax returns, or pension notices.

- Address: current residence inside Japan, plus a reachable domestic phone line.

- Credit history: no serious delinquencies recorded by domestic credit bureaus.

- Guarantee: approval from the bank’s partnered guarantor company (no personal guarantor required).

Application Channels

Choosing in-branch or online affects speed, convenience, and potential rate perks.

In-Branch Process

Face-to-face support helps you clear doubts in real time, and most discounts require signing at a branch.

- Gather identification and income proof.

- Visit a Chugoku Bank branch and request the loan application form.

- Complete the questionnaire; staff check documents on the spot.

- Receive provisional results, often within the same visit.

- Sign the agreement; funds become available shortly after card issuance.

Online Process

Digital entry suits busy residents or applicants outside the branch network.

- Open Chugoku Bank’s secure loan page.

- Input personal and employment details; upload scanned documents.

- Review electronic agreements and permit automatic credit checks.

- Await notification—typically two to three business days—for approval status.

- Agree to the contract digitally, receive the card by post, and start drawing funds.

Online contracts do not qualify for Mini’s relationship discounts or Koreca’s home-loan rates, so weigh convenience against extra cost.

Document Checklist for Smooth Approval

Pre-sorting paperwork shortens underwriting time.

- Government ID (driver’s license, My Number card, or passport)

- Proof of address dated within three months (utility bill or residence certificate)

- Latest payslip, tax return, or pension statement showing annual income

- Mortgage agreement (only if seeking Koreca preferential pricing)

- Bankbook pages verifying salary or pension credits for Mini discounts

Strengthen Your Application With Simple Moves

Smart preparation improves internal scoring and may unlock lower tiers.

- Keep existing revolving balances below one-third of total credit limits.

- Arrange salary deposits directly into a Chugoku Bank account at least one payday before applying.

- Avoid submitting other loan requests within two months; clustered inquiries trigger risk flags.

- Confirm each form field against supporting documents—typos or mismatches slow the process.

- Reserve a buffer in your primary account to cover the first automatic repayment smoothly.

Manage Interest and Repayment Like a Pro

Staying proactive protects your budget and credit score.

- Set automatic debits: schedule the deduction one business day after payday to prevent accidental overdrafts.

- Monitor floating rates: review quarterly notices; raise monthly payments if rates climb to keep amortization on track.

- Use bonus months: apply work-bonus cash toward principal; the bank allows lump repayments without penalty.

- Check annual statements: verify remaining balance, interest charged, and outstanding limit to spot discrepancies early.

Contact Point for Quick Support

For questions on rates, documents, or application status, call the International Department at Chugoku Bank Head Office: +81 86 234 6539 (weekday business hours, Japanese and English support).

Conclusion

Align loan size with your repayment capacity, gather the necessary documents before visiting the branch or starting the online form, and take advantage of loyalty discounts when eligible.

Following the steps in this guide positions you for prompt approval, predictable costs, and a stable banking partnership that supports your goals throughout Japan.