If you’re living in Japan for more than three months, you’re required to enroll in a health insurance plan.

Understanding how the system works will help you avoid high medical costs and ensure you get proper care when needed.

This quick guide breaks down the basics, allowing you to navigate Japan’s health insurance system easily and confidently.

Who Needs Health Insurance in Japan

Health insurance isn’t optional in Japan—it’s a legal requirement for most residents.

Whether you’re working, studying, or staying in the area long-term, you need to be covered under a public plan. Here’s who must enroll:

- Foreign residents staying in Japan for more than 3 months

- Full-time employees working at Japanese companies

- Freelancers, part-time workers, and the self-employed

- International students enrolled at Japanese schools or universities

- Unemployed individuals registered as residents

- Spouses and dependents of insured individuals

Everyone in these categories must enroll in either National Health Insurance (NHI) or Employee Health Insurance (Shakai Hoken), depending on their situation.

Main Types of Health Insurance

Japan has two central public health insurance systems. The one you join depends on your employment status and residency situation.

Here’s a breakdown of each:

National Health Insurance (NHI / 国民健康保険)

- For students, part-time workers, freelancers, and the unemployed

- Managed by local city or ward offices

- You pay the full premium based on your income

- Apply directly at your local city hall

Employee Health Insurance (Shakai Hoken / 社会保険)

- For full-time employees at companies

- Your employer handles enrollment

- Premiums are split between you and the company

- Includes pension contributions and other benefits

What Health Insurance Covers

Japan’s health insurance system covers a wide range of essential medical services. Below are the main types of care included, with short explanations:

- Medical Visits – Covers general checkups, specialist consultations, and outpatient services.

- Hospitalization – Includes room charges, surgeries, and inpatient care.

- Prescription Drugs – Most medications prescribed by doctors are covered under this plan.

- Dental Care – Basic procedures, including cleanings, fillings, and extractions, are included.

- Maternity Services – Prenatal checkups and childbirth-related care are partially covered.

- Mental Health – Access to psychiatric consultations and treatments at approved clinics.

- Emergency Services – Ambulance transport and urgent care are included.

- Rehabilitation – Physical therapy and recovery treatments may be covered when prescribed by a healthcare professional.

How to Apply

Enrolling in Japan’s health insurance depends on your job status and residency type.

The process is straightforward, but you need to act quickly after arriving or starting a new job. Here’s how to apply based on your situation:

National Health Insurance (NHI)

- Where to apply: Your local city or ward office

- What to bring: Residence card, My Number card or notification, passport

- When to apply: Within 14 days of moving to Japan or changing your status

- Who should apply: Freelancers, students, part-timers, unemployed

Employee Health Insurance (Shakai Hoken)

- Where to apply: Your employer handles it

- What to do: Submit the required personal documents to HR

- When to apply: Immediately after joining the company

- Who should apply: Full-time employees, company workers

Monthly Premiums and Payment

In Japan, health insurance premiums vary based on your employment status and income. Here’s a breakdown of the two main types:

National Health Insurance (NHI / 国民健康保険)

- Who it’s for: Self-employed individuals, part-time workers, students, and the unemployed.

- Premium calculation: Based on your previous year’s income and the number of insured household members.

Typical costs:

- If you had no income in the previous year, premiums can be as low as ¥2,000–¥3,000 per month.

- Without an income declaration, you might receive a default bill of around ¥10,000 per month.

Payment methods:

- Monthly invoices are sent by mail.

- Payable at banks, post offices, convenience stores, or via automatic bank transfer.

Employee Health Insurance (Shakai Hoken / 社会保険)

- Who it’s for: Full-time company employees.

- Premium calculation: Based on your monthly salary.

Typical costs:

- Employees aged 20–40: approximately 9.93% of the monthly salary for health insurance.

- Employees aged 40–65: approximately 11.58% (includes nursing care insurance).

- Pension contribution: approximately 18.3% of the monthly wage.

- Premiums are split equally between the employer and the employee.

Payment methods:

- Automatically deducted from your monthly salary.

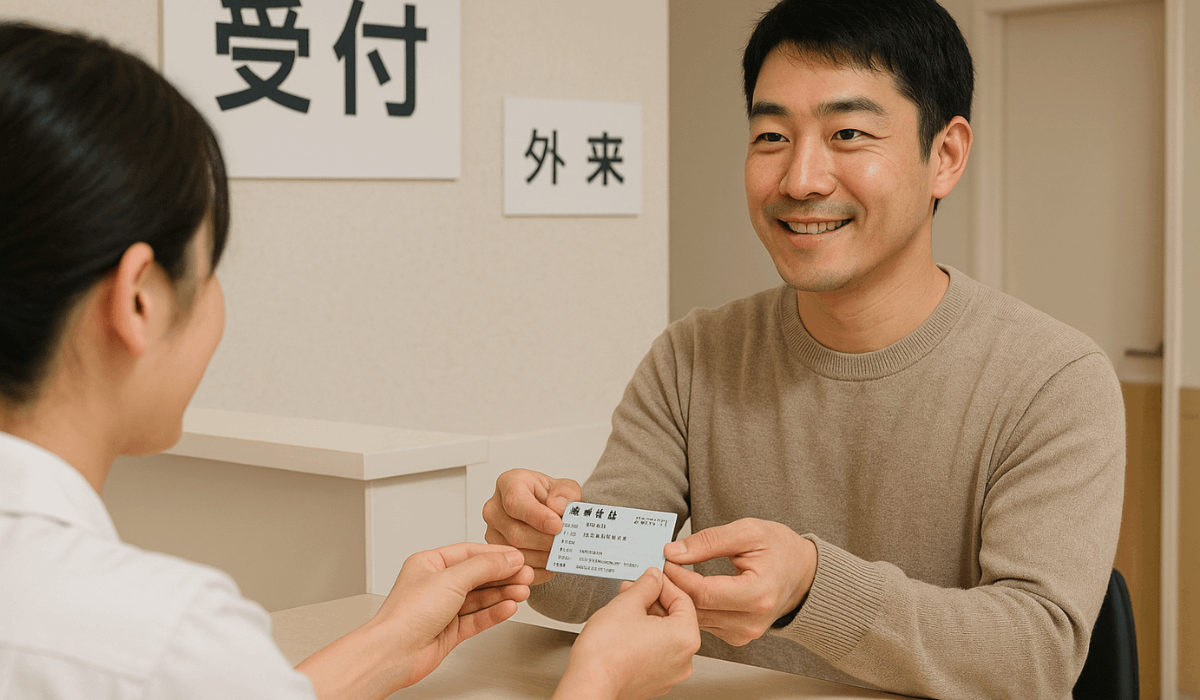

Insurance Card (Hokensho)

Once you’re enrolled in a health insurance plan in Japan, you’ll receive an insurance card called a Hokensho.

This card is your proof of coverage and is required every time you visit a hospital, clinic, or pharmacy. Here’s what you need to know:

What It Is:

- A personal identification card that shows you’re covered under Japan’s public health insurance.

When You Get It:

- Issued shortly after enrolling in either National Health Insurance or Employee Health Insurance.

How to Use It:

- Present it at the reception of any medical facility before receiving treatment.

Why It Matters:

- Without it, you’ll need to pay 100% of the medical cost upfront instead of just 30%.

What’s on the Card:

- Your name, insurer number, insured person number, and the validity period.

When to Update It:

- If you move, change jobs, or switch to a different type of insurance, you must return the old card and receive a new one.

Lost or Damaged Card:

- Report it to your city office or employer and request a replacement.

Additional Financial Support

Japan offers additional financial assistance for specific medical situations.

If costs get too high or you experience events like childbirth, these programs can ease the burden. Here are the key options:

High-Cost Medical Expense Benefit (Kōgaku Ryōyōhi Seido)

- If your monthly medical costs pass a set limit, the extra amount is refunded.

- Apply through your insurer after treatment.

Childbirth Lump-Sum Allowance (Shussan Ichi-ji Kin)

- A one-time payment of around ¥420,000 for childbirth expenses.

- Given that you’re insured and deliver at a recognized facility.

Funeral Expense Subsidy

- A fixed amount (usually ¥50,000) is paid to help with funeral costs.

- Available to families of the insured who pass away.

Medical Expense Deductions (Tax Relief)

- High medical costs can be partially claimed during tax filing.

- Save receipts and documents to apply.

Low-Income Household Support

- Premiums may be reduced or waived if your income is low.

- Apply at your local city office.

Coverage for Foreign Students and Temporary Residents

If you’re coming to Japan as a student or for a short stay, your access to public health insurance depends on your visa status and the duration of your stay.

Here’s how coverage works for international students and temporary residents:

Foreign Students (Visa over 3 months)

- Must enroll in National Health Insurance (NHI).

- Apply at your local city or ward office after registering your address.

- You’ll get the same 70% coverage as residents.

Students with Scholarships or Exchange Programs

- Some programs offer private insurance or subsidies to help offset the costs.

- Check with your school to see if there are any extra coverage options available.

Temporary Residents (Staying under 3 months)

- Not eligible for public health insurance.

- Must get travel or private health insurance before arrival.

Short-Term Visa Holders (Tourists, Business Visitors)

- Cannot join NHI or Shakai Hoken.

- Must rely entirely on private insurance for any medical needs.

What to Bring to Apply (for students)

- Residence card, passport, student ID, and My Number.

The Bottomline

Understanding Japan’s health insurance system is crucial for staying protected and avoiding unexpected medical expenses.

Whether you’re a worker, student, or long-term resident, enrolling in the right plan ensures access to affordable care.

Take action now—register for the appropriate insurance and keep your coverage current.