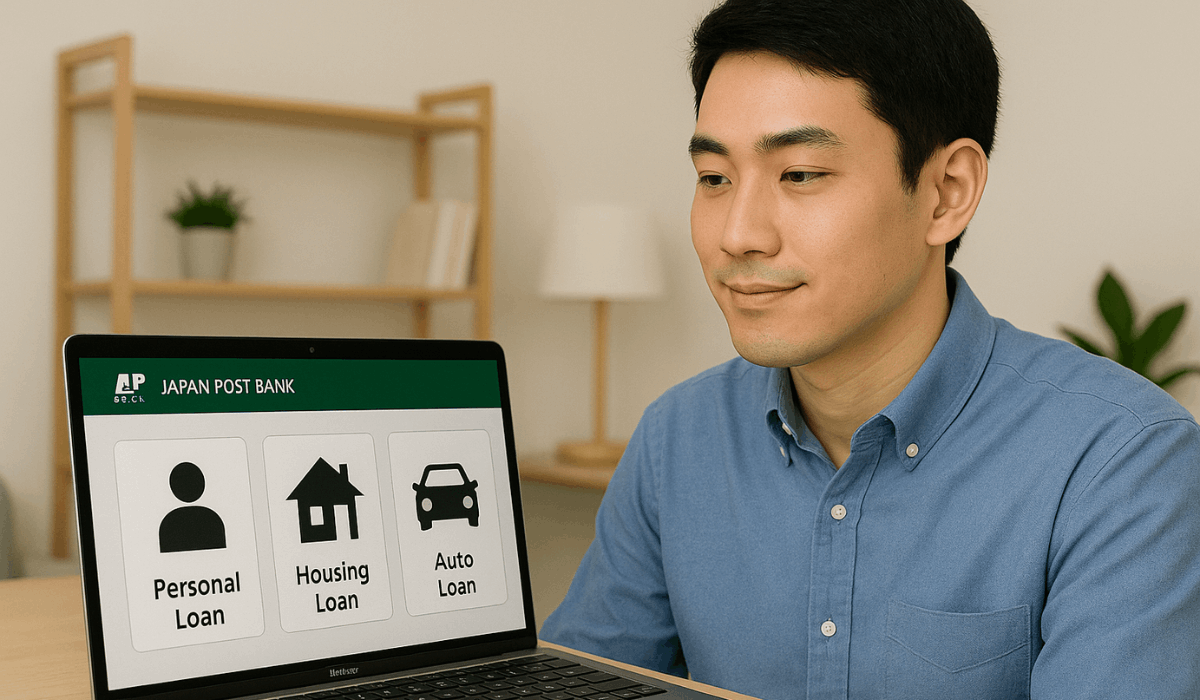

Applying for a Japan Post Bank loan online is efficient and straightforward, offering options such as personal, housing, and auto loans.

With the convenience of applying from home, you can quickly navigate through the steps and receive a fast decision.

This guide covers the application process, eligibility, interest rates, and fees for a smooth experience.

Types of Loans Available

Japan Post Bank offers various loan options to meet different financial needs:

- Personal Loans: Unsecured loans for expenses like medical bills, education, or home improvements, with flexible terms.

- Housing Loans: Loans to purchase or refinance a home, offering competitive rates and long repayment terms.

- Auto Loans: Loans for buying new or used vehicles, with various interest rates and flexible payments.

- Other Specialized Loan Products: Loans for specific needs, such as renovations or business, with tailored terms.

Interest Rates and Fees

Here’s an overview of the competitive rates and fees for the bank’s loan products:

- Personal Loans: Interest rates range from 1.5% to 3.5% annually. Administrative fees may apply based on the loan type.

- Housing Loans: Rates vary by plan, with options like “Flat 35” offering fixed rates. Fees can include a 2.2% or flat ¥22,000 fee, depending on the plan.

- Auto Loans: Interest rates range from 1.0% to 2.5%, depending on the loan amount and term.

- Other Specialized Loan Products: Rates and fees are tailored to specific loans, such as renovations or business needs.

Eligibility Requirements

To apply, you must meet specific criteria. Here’s what you need to know:

- Age: Applicants must be between 20 and 70 years old at the time of application.

- Residency Status: You must be a resident of Japan.

- Income: Proof of stable income is required.

- Employment: A valid employment contract or proof of business ownership is necessary.

- Credit History: A positive credit history is essential for loan approval.

Step-by-Step Online Application Process

Applying for a loan with Japan Post Bank online is a straightforward process. Follow these steps to complete your application:

- Install the Japan Post Authentication App: Download the app from your device’s app store to verify your identity during the application process.

- Access the Loan Application Website: Visit the official Japan Post Bank loan application page.

- Enter the Confirmation Code: Open the authentication app and input the confirmation code provided.

- Fill out the Application Form: Provide necessary details such as your income, address, and employment information.

- Upload Required Documents: Submit scanned copies of your identification and proof of income.

- Review and Submit: Double-check all information for accuracy before submitting your application.

- Await Approval: Processing times may vary; typically, decisions are made within a few business days.

What to Do if Your Loan Application is Denied

If your loan application is denied, don’t be discouraged. Here’s what you can do:

- Check the Denial Notice: Review the reasons for denial, such as low credit score or high debt. This helps you understand what to fix.

- Get Your Credit Report: Request your credit report to find any mistakes. Dispute any errors to improve your score.

- Improve Your Financial Situation: Boost your credit score by paying bills on time, reducing debt, and increasing income.

- Consider Other Lenders: Explore options such as credit unions or online lenders if traditional banks reject your application.

- Reapply When Ready: After improving your financial profile, you can reapply for the loan with better chances of approval.

Common Issues and Troubleshooting

While applying for a loan online, you may encounter a few issues. Here are some common problems and how to resolve them:

- Application Rejection: Ensure all information is accurate and complete. If rejected, review your credit report or address any outstanding debts.

- Document Upload Issues: Check file formats and sizes. Ensure scanned documents are clear and legible.

- Technical Problems: Clear your browser cache or try a different browser if the page isn’t loading correctly.

- Identity Verification Failure: Double-check the confirmation code entered in the authentication app. Ensure the app is up-to-date.

- Slow Processing: Wait for a few business days for approval. If delayed, contact customer service for updates.

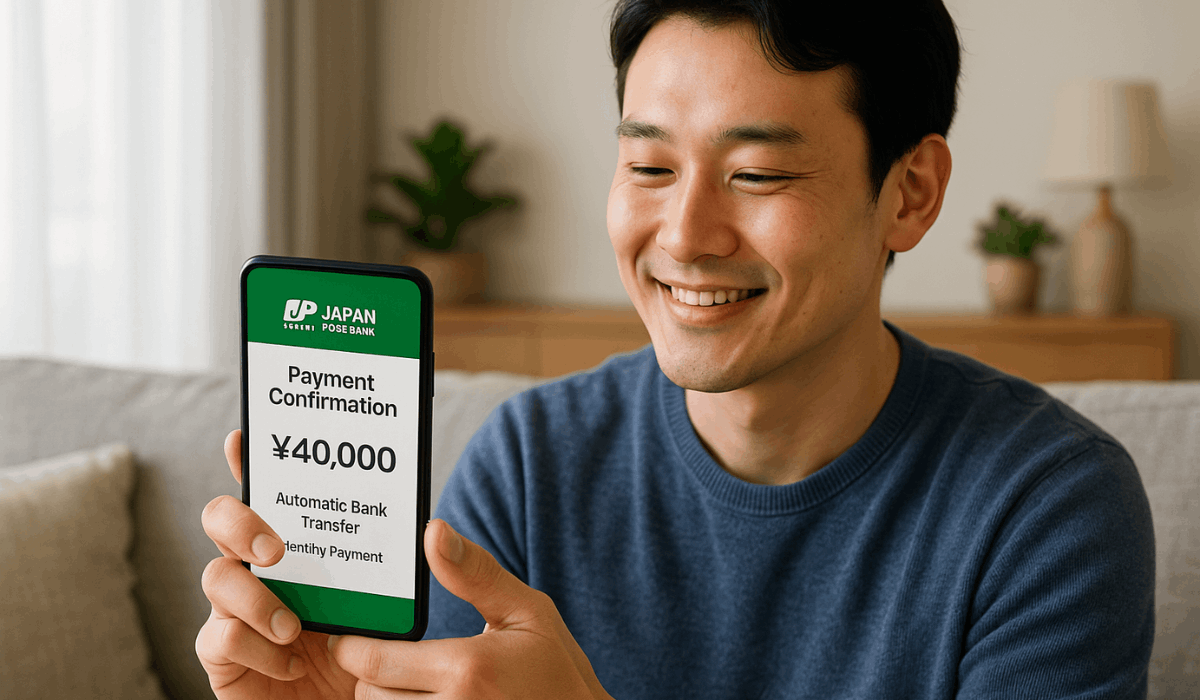

Loan Repayment Options

Understanding your loan repayment options is essential for managing your finances effectively.

Japan Post Bank offers several flexible repayment methods to suit different needs. Here’s a breakdown of the available options:

- Monthly Payments: Fixed monthly payments based on your loan amount and interest rate are paid until the loan is fully repaid.

- Early Repayment: Repay the loan early to reduce interest, but be aware of any associated fees.

- Automatic Bank Transfers: Set up automatic deductions to ensure timely payments and avoid late fees.

- Bullet Repayment: Pay the principal in a lump sum at the end of the term, with periodic interest payments.

- Flexible Payment Plans: Adjust payments or terms during financial difficulty; contact customer service for details.

Benefits of Using Japan Post Bank for Your Loan

Japan Post Bank offers several advantages for borrowers seeking loans. Here’s a concise list of key benefits:

- Competitive Interest Rates: Enjoy lower interest rates compared to many other financial institutions, making borrowing more affordable.

- Flexible Repayment Options: Choose from flexible repayment plans, including monthly payments and early repayment options, to fit your needs.

- Convenient Online Application: Apply for loans securely through the bank’s online platform, eliminating the need for in-person visits.

- Wide Accessibility: Access a vast network of ATMs nationwide, ensuring you can manage your loan and finances with ease.

- Reputable Institution: Benefit from the stability and trust associated with Japan Post Bank, a leading financial institution in Japan.

Customer Support and Assistance

Japan Post Bank offers multiple channels to assist customers with loan inquiries and concerns. Here’s how you can get help:

Phone Support:

- Japanese: 0120-108-420 (Weekdays: 8:30–21:00, Weekends & Holidays: 9:00–17:00)

- English: 0570-046-111 (Weekdays: 8:30–18:00)

Online Chat:

- Use the AI-powered chatbot available on the official website for 24/7 assistance.

Email Inquiries:

- Submit questions via the contact form on the official website.

Branch Visits:

- Visit your nearest Japan Post Bank branch during business hours for in-person assistance.

For non-Japanese speakers, English-language support is available during specified hours. It’s advisable to call during these times for assistance.

The Bottomline

Applying for a loan with Japan Post Bank is straightforward, offering competitive rates and flexible options tailored to your needs.

With easy online access and reliable customer support, you can confidently manage your loan application process.

Take the first step today by visiting the Japan Post Bank website and applying for your loan online.

Disclaimer

The information provided in this article is for general guidance purposes only and may be subject to change.

For the most up-to-date details on loan options, eligibility, and terms, please visit the Japan Post Bank website or contact customer support directly.