JASSO student loans provide structured financial support for individuals whose household income cannot fully cover educational costs in Japan.

The program supports a wide range of students by offering need-based grants, interest-free loans, and low-interest repayment options tied to income level and school attendance.

This guide outlines each funding type, eligibility rule, and application step to help you prepare with confidence.

JASSO Student Loans

JASSO operates under Japan’s Ministry of Education, Culture, Sports, Science and Technology, administering scholarships, loans, and campus-life programs designed to help creative thinkers lead the next generation.

Its loan arm provides fixed-term financial assistance to applicants whose family resources are insufficient to fully cover tuition or living costs.

The amount, interest rate, and repayment schedule vary according to each borrower’s economic background, rather than their academic major, making the program accessible to a broad range of disciplines.

JASSO Student Loans Mission

The organization also fosters worldwide academic exchange by funding overseas scholars, administering the Examination for Japanese University Admission for International Students, and providing data and training that universities utilize to enhance student-support services.

Because JASSO’s portal operates primarily in Japanese, non-native speakers should plan extra time for translation or bilingual guidance.

Eligibility Requirements at a Glance

Knowing up front whether you qualify saves time and avoids incomplete applications.

- Applicants include prospective high school graduates, recent graduates within two years, or individuals who passed senior-high equivalency exams accepted by JASSO.

- The household must show financial need through income statements or proof of government assistance such as seikatsu hogo (public livelihood support).

- Both international and Japanese residents may apply, making the program viable to learners worldwide who satisfy residency and identification rules.

Financial Criteria

Loan officers evaluate parent or guardian income, residential tax status, and any existing aid. Families paying no residential tax or receiving government life support typically meet the need threshold.

Those slightly above that line can still qualify if annual earnings match the loan amount requested and other debts are limited.

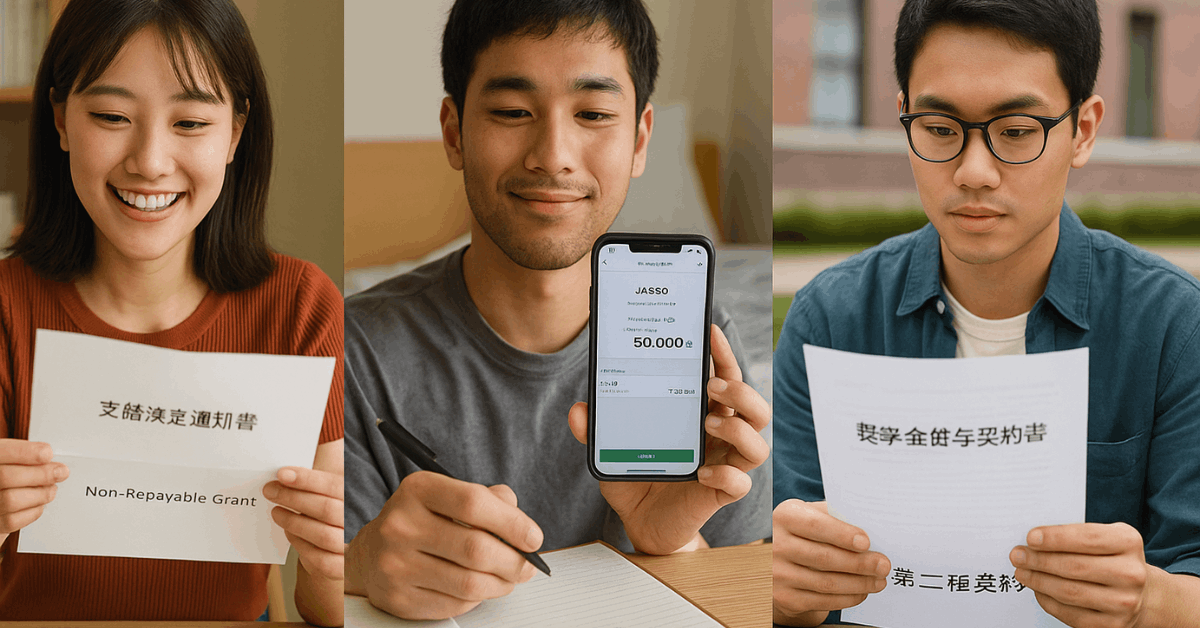

Types of Support You Can Access

Blended funding improves educational stability and broadens future opportunities.

- Scholarship Grants – Non-repayable awards for outstanding scholastic or extracurricular performance.

- Interest-Free Loans (First-Type) – Monthly funding that carries no interest during or after school, subject to strict need tests.

- Low-Interest Loans (Second-Type) – Flexible monthly amounts with interest accruing after graduation at a capped rate (floating or fixed), ideal when tuition or living costs exceed the first-type ceiling.

- Supplementary Programs – Language courses, cultural-exchange events, and counseling that help you integrate on campus and globally.

Each stream can be combined, allowing you to tailor assistance to individual cost projections and payback comfort.

Where to Begin Your Application

Start locally even if your career vision is global. High schools distribute an official pamphlet that outlines loan features and embeds the paper forms required for first submission.

Teachers typically host short orientations in early spring; attending one minimizes mistakes later in the online system. Students outside Japan can download the same materials directly from JASSO’s website, though navigation will be in Japanese.

Tip: Ensure that your name on school records, passport, and resident card matches exactly; mismatches in kana or romanization can cause processing delays.

Preparing Essential Documents

A structured checklist helps you stay on schedule and avoid last-minute scrambles.

- Student Loan Contract Forms –

- Kyuufu Shōgaku-kin Kakunin-sho (grant confirmation)

- Taiyō Shōgaku-kin Kakunin-sho (loan confirmation)

- Application Confirmation Form – Captures academic status, loan type, and requested monthly amount.

- My Number Submission Form – Lists personal and guardian 12-digit ID numbers plus photocopies of both cards or approved alternatives.

- Income Evidence – Recent tax certificates, payslips, or welfare statements translated into Japanese, where needed.

- Bank Details – A domestic account for disbursement; international learners can open a basic account after arrival.

Ensure every photocopy is clear, stamped “true copy,” and dated within three months of filing.

Filling Out the Forms: A Practical Walk-Through

Efficient completion prevents errors that trigger rejection or rerouting.

- Begin with the Application Confirmation Form. Use black ink, block letters, and no abbreviations. State your intended university, faculty, and month of enrollment.

- Move to the My Number Form. Affix card copies with glue, not staples, and add katakana furigana above each name field for clarity.

- Check the Contract Forms. Tick grant, interest-free loan, low-interest loan, or any mix, then input the monthly amount in yen. Entering excessive requests often leads to downsizing, so base estimates on tuition invoices and housing quotes.

Before submission, photocopy the entire packet for your records.

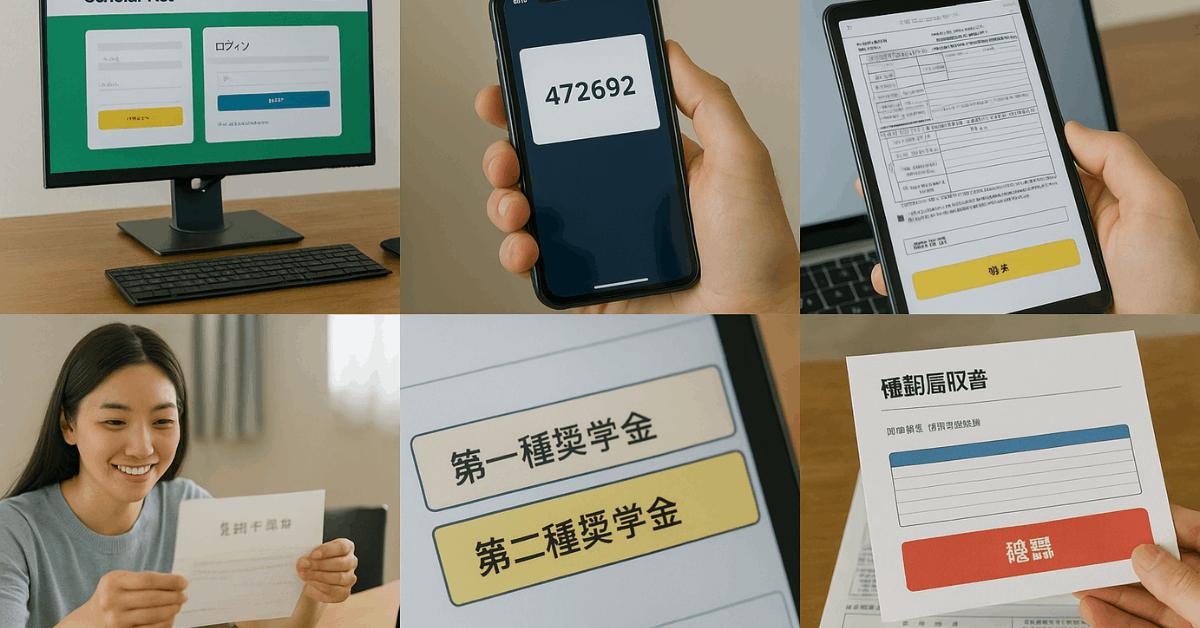

Submitting Your Application Online via ScholarNet

Digital filing finalizes your request and starts the official review clock.

Step-by-Step Portal Guide

A concise sequence keeps you focused while navigating the Japanese-only interface.

- Create a Scholar Net ID using the ten-digit code printed on your paper packet’s barcode.

- Set Up Two-Factor Authentication by linking a mobile number reachable worldwide.

- Input Personal Data exactly as written on the paper forms, including numeric separators and honorifics.

- Upload Income PDFs under the 明細 (statement) tab. File sizes above 2 MB must be compressed.

- Select Loan Type and Amount by choosing 第一種 (interest-free) or 第二種 (low-interest) and entering monthly figures.

- Review and Submit. The system offers a red “確認” (confirm) button that previews entries before you press the blue “送信” (send) button.

- Print the Digital Receipt and staple it to the front of the hard-copy packet.

Finally, hand the packet to your teacher or school office, or mail it registered if applying after graduation.

After Submission: What Happens Next

Understanding the timeline helps you plan finances without guesswork.

- Pre-Assessment (2–3 weeks) – JASSO screens documents for missing data; you may receive an email requesting clarification. Respond within seven days to avoid automatic cancellation.

- Final Review (6–8 weeks) – Financial officers calculate eligibility and potential loan ceilings.

- Notification of Results – An acceptance letter plus login instructions for the “Contract Approval” page arrives at school or your registered address.

- Funds Disbursement – Monthly payments begin in April or October, depending on your program’s start date, and continue until graduation or your requested end month.

Interest for second-type loans is locked each March and resets annually, capped to protect borrowers from sharp market swings.

Tips for International Applicants in Japan

Language barriers and unfamiliar administrative steps can seem daunting, yet many overseas students secure funding each year.

- Invest in a certified translation of tax documents before arrival to avoid courier delays.

- Pair up with a Japanese-speaking classmate during Scholar Net entry; dual review reduces typographical errors.

- Schedule municipal office visits early to receive the My Number card, which normally takes three to four weeks after resident registration.

- Use JASSO’s Student Exchange Division helpline; staff handle inquiries in English during limited afternoon slots. Having your Scholar Net ID ready speeds up assistance.

Additional Resources and Support

Staying informed positions you for smoother borrowing and repayment.

- University Financial-Aid Offices – Many campuses host dedicated advisers who liaise with JASSO, translating notices and arranging group tutorials.

- Prefectural Scholarship Programs – Regional governments sometimes layer extra grants on top of JASSO loans; check local boards soon after acceptance.

- Embassy Education Sections – Diplomatic missions often maintain updated lists of scholarships available to citizens studying in Japan and worldwide.

- Online Communities – Forums such as r/movingtoJapan and specialized Discord servers share real-time experiences, document templates, and cost breakdowns.

When used together, these channels enhance your application accuracy and confidence while maintaining transparent repayment obligations.

Conclusion

Applying for a JASSO student loan requires careful preparation, accurate documentation, and timely follow-through at each step.

From school-based orientations to final online submission, the process is designed to ensure that funding reaches qualified applicants who demonstrate both financial need and academic commitment.

Following the correct procedures and using support resources improves your chances of approval and helps you manage educational expenses more effectively throughout your time in Japan.