Applying for an SMBC Mobit Loan online is a quick and straightforward process that can help you secure the funds you need.

With flexible loan amounts and competitive interest rates, SMBC Mobit makes it easy to manage your finances.

Follow these simple steps to complete your application and get approved more quickly, all from the comfort of your own home.

What is the SMBC Mobit Loan?

SMBC Mobit Loan is an unsecured personal loan service in Japan, offering flexible repayment options and quick online approval.

Features and Benefits:

- Unsecured Loans: No collateral required.

- Flexible Loan Amounts: Borrow up to ¥8 million.

- Competitive Interest Rates: Annual rates range from 3.0% to 18.0%.

- Quick Processing: Preliminary screening in 10 seconds; final approval within 15 minutes.

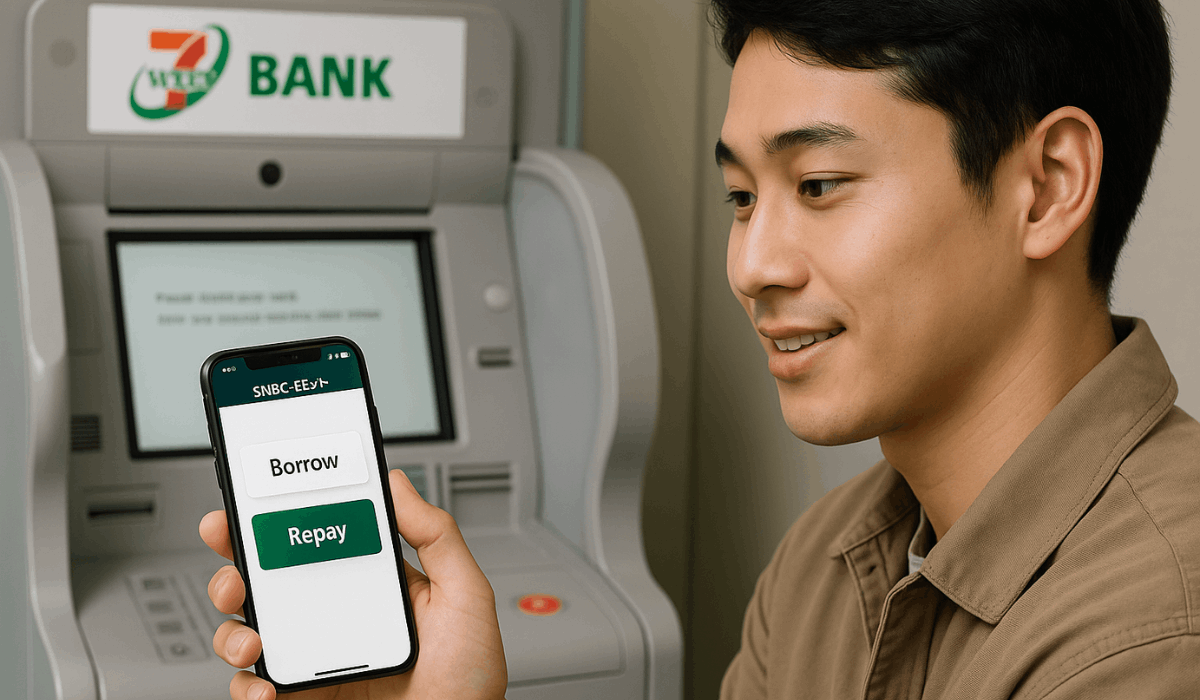

- Cardless Transactions: Use the official app for borrowing and repayment at Seven Bank and Lawson Bank ATMs.

- T-Point Integration: Earn 1 point for every ¥200 in interest paid; points can be used for repayments.

- No Workplace Verification: No phone calls to your employer during the application process.

- Available for Foreign Residents: Open to non-permanent residents with valid documentation.

Interest Rates and Fees:

- Interest Rates: 3.0% to 18.0% per annum.

- Late Payment Fee: 20.00% annual rate on outstanding balances after the due date.

- Early Repayment: No fees for partial early repayments made via phone (reduces repayment period).

- ATM Fees: No charges apply at affiliated ATMs; fees may be incurred at non-affiliated ATMs.

Why Choose SMBC Mobit Loan?

It offers a range of advantages tailored to meet your financial needs efficiently and securely.

- Quick Approval Process: Preliminary screening takes just 10 seconds, with final approval often within 15 minutes, ensuring fast access to funds.

- Flexible Loan Amounts: Borrow up to ¥8 million, accommodating various financial requirements.

- Competitive Interest Rates: Annual rates range from 3.0% to 18.0%, offering affordable borrowing costs.

- Cardless Transactions: Use the SMBC Mobit app to borrow and repay at Seven Bank and Lawson Bank ATMs; no physical card is needed.

- T-Point Integration: Earn 1 point for every ¥200 of interest paid, with each point equivalent to ¥1, which can be used towards loan repayments.

- No Workplace Verification: The application process does not require confirmation of employment, ensuring privacy and discretion.

- Available to Foreign Residents: Non-permanent residents with valid documentation are eligible to apply, broadening accessibility.

Step 1: Check Your Eligibility

Before applying, ensure you meet the following criteria:

- Age: Must be between 20 and 74 years old.

- Residency: Must reside in Japan.

- Income: Must have a stable income.

- Credit History: Must have a satisfactory credit history.

- Documentation: Must provide necessary identification and income verification documents.

Step 2: Gather Required Documents

Prior to submitting your application, it’s important to gather the required documents to ensure a smooth process.

Identification Proof:

- A valid residence card or special permanent resident certificate

Income Verification (if borrowing ¥500,000 or more): One of the following documents:

- Withholding tax certificate

- Tax return form

- Recent wage statements (last two months)

Note: For loans under ¥500,000, only identification proof is required. Ensure all documents are current and legible to facilitate a quick approval process.

Step 3: Visit the SMBC Mobit Loan Website

To begin your application for an SMBC Mobit Loan, access the official website.

This platform provides comprehensive information and facilitates the online application process.

Accessing the Website:

- Official Website: To begin your application for an SMBC Mobit Loan, access the official website

Key Features on the Website:

- Online Application: Apply for your loan directly through our website.

- Loan Information: Review detailed information about loan amounts, interest rates, and repayment terms.

- Eligibility Check: Assess your eligibility for the loan before applying.

- Customer Support: Access contact information for customer service assistance.

Ensure you have all necessary documents prepared before starting your application to streamline the process.

Step 4: Fill Out the Online Application Form

Completing the online application form for this loan is a straightforward process that can be done from the comfort of your home.

Key Information Required:

- Personal Details: Full name, date of birth, residential address, and contact information

- Employment Information: Employer’s name, position, and annual income

- Financial Information: Details of any existing debts or obligations

- Loan Request: The desired loan amount and preferred repayment period

Document Submission:

- Identification Proof: A valid residence card or special permanent resident certificate

- Income Verification (if borrowing ¥500,000 or more): Recent wage statements (last two months) or tax-related documents

Application Process:

- Access the Application Form: Visit the official SMBC Mobit Loan website.

- Complete the Form: Enter all required information accurately.

- Submit Documents: Upload clear copies of the required documents.

- Review and Submit: Double-check all entries and submit your application.

Step 5: Submit the Application

After completing the online application form, submitting your application is the final step to initiate the loan process.

Submission Methods:

- Online Submission: After completing the application form and uploading the required documents, submit them directly through the website.

- Mobile App Submission: Alternatively, you can use the official SMBC Mobit app to submit your application and documents.

Post-Submission Process:

- Preliminary Screening: Upon submission, a preliminary screening of your application will be conducted.

- Approval Notification: If your application passes the screening, you’ll receive an approval notification.

- Loan Disbursement: Following approval, the loan amount will be disbursed to your designated account.

Step 6: Wait for Approval and Disbursement

Once you’ve submitted your loan application, the next step is to wait for approval and the disbursement of funds.

Approval Process:

- Preliminary Screening: Upon submission, a preliminary screening of your application will be conducted.

- Final Approval: If your application passes the preliminary screening, you’ll receive an approval notification.

Disbursement:

- Fund Transfer: Following approval, the loan amount will be transferred to your designated bank account.

- Timing: The timing of the disbursement may vary based on the financial institution and the time of day the application was approved.

Customer Support: How to Get Help During the Loan Process

If you need assistance during the loan application, several support channels are available to guide you through each step.

Contact Methods:

- Phone Support (Operator Assistance): For personalized help, call 03-5908-0241 for SMBC Mobit customer support.

- Online Support: Visit the SMBC Mobit website to access FAQs, live chat, or email support for general inquiries.

- Mobile App Assistance: Use the official SMBC Mobit app to access support features, including document submission and loan tracking.

Support Hours:

- Phone Support: Available during business hours, Monday to Friday, 9:00 AM to 6:00 PM (Japan Time).

- Online Support: Accessible 24/7 for general inquiries; response times may vary.

The Bottomline

In conclusion, applying for an SMBC Mobit Loan online is a simple and efficient process that can provide you with the financial support you need.

By following the outlined steps, you can complete your application with ease and receive quick approval.

Visit the official SMBC Mobit website today to get started and secure your loan!

Disclaimer

The information provided in this article is for general informational purposes only and may be subject to change.

Please refer to the official SMBC Mobit website for the most accurate and up-to-date details regarding loan terms, eligibility, and application procedures.